10 Smart Strategies for Funding Your Next Getaway

Posted on: Monday, March 4th, 2024

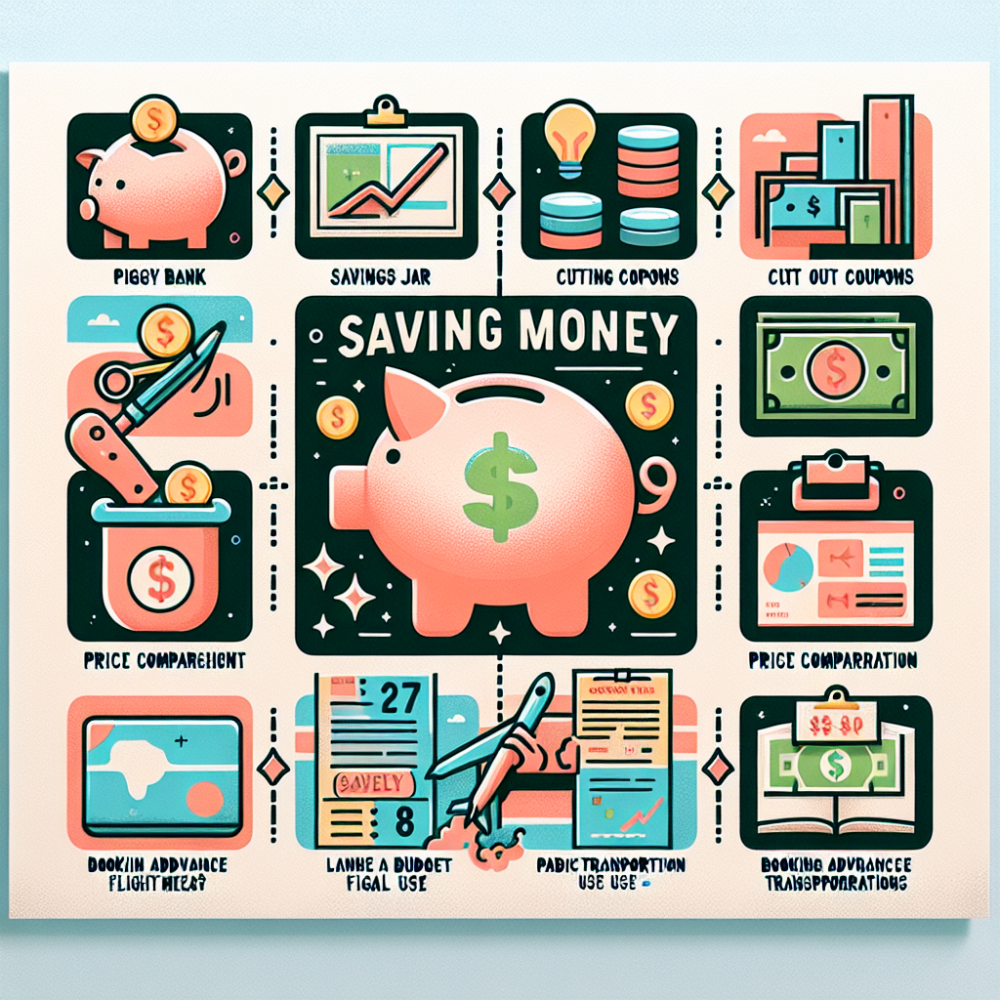

Planning a vacation doesn’t start with booking flights or packing your bags; it begins with the financial groundwork laid months, or even years, in advance. In today's economic landscape, saving for a holiday requires more than just stashing away spare change. It demands a proactive, strategic approach that aligns with your travel goals and financial situation. This guide offers ten practical tips to help you efficiently save for your next vacation, ensuring your travel dreams don’t remain just out of reach.

1. Set a Clear Vacation Budget: Before saving, determine how much your vacation will cost. Include expenses like travel, accommodation, food, entertainment, and miscellaneous items. Knowing your target will make it easier to save systematically.

2. Open a Dedicated Savings Account: Create a separate savings account specifically for your vacation fund. Look for options with high interest rates and no fees, to make your money work harder for you. This also helps in tracking your progress and prevents mingling vacation savings with other funds.

3. Automate Your Savings: Set up an automatic transfer from your checking to your vacation savings account each payday. Automating saves you the hassle of remembering to transfer and prevents spending the money elsewhere. Even small, consistent contributions can add up over time.

4. Cut Unnecessary Expenses: Review your monthly expenses and identify areas where you can cut back. Common culprits include dining out, subscriptions you rarely use, and impulse purchases. Redirect these funds to your vacation savings instead.

5. Sell Unused Items: Most of us have things lying around that we no longer use or need. Selling these items online or at a garage sale can provide a nice boost to your vacation fund. Plus, it’s a great way to declutter your space!

6. Look for Additional Income Sources: Consider freelancing, part-time jobs, or selling crafts or homemade goods as a way to increase your income. Each extra dollar earned can be directed towards your vacation savings.

7. Monitor Spending with Apps: Financial apps can help you keep track of your spending and savings. Use them to set budgets, monitor transactions, and get notified of any unusual expenses that could derail your savings plan.

8. Take Advantage of Rewards and Cashback: If you use a credit card, choose one that offers travel rewards or cashback on purchases. These benefits can be directed into your vacation fund. However, be sure to pay off the balance each month to avoid interest charges.

9. Be Flexible with Travel Dates and Destinations: Sometimes, being open to different travel dates or locations can save you a lot of money. Look out for deals and discounts during off-peak seasons or consider destinations that are not overly touristy yet still offer a rich experience.

10. Start Saving Early: The sooner you start saving, the less financial stress you’ll face as your vacation dates approach. An early start gives you more time to accumulate savings and take advantage of compounding interest in your dedicated account.

By implementing these ten tips, you can build a robust vacation fund that enables you to enjoy your time off without financial worry. A bit of planning, discipline, and creativity in your savings approach can open the door to the vacation experiences you’ve always dreamed of. Start today, and watch your vacation fund grow!