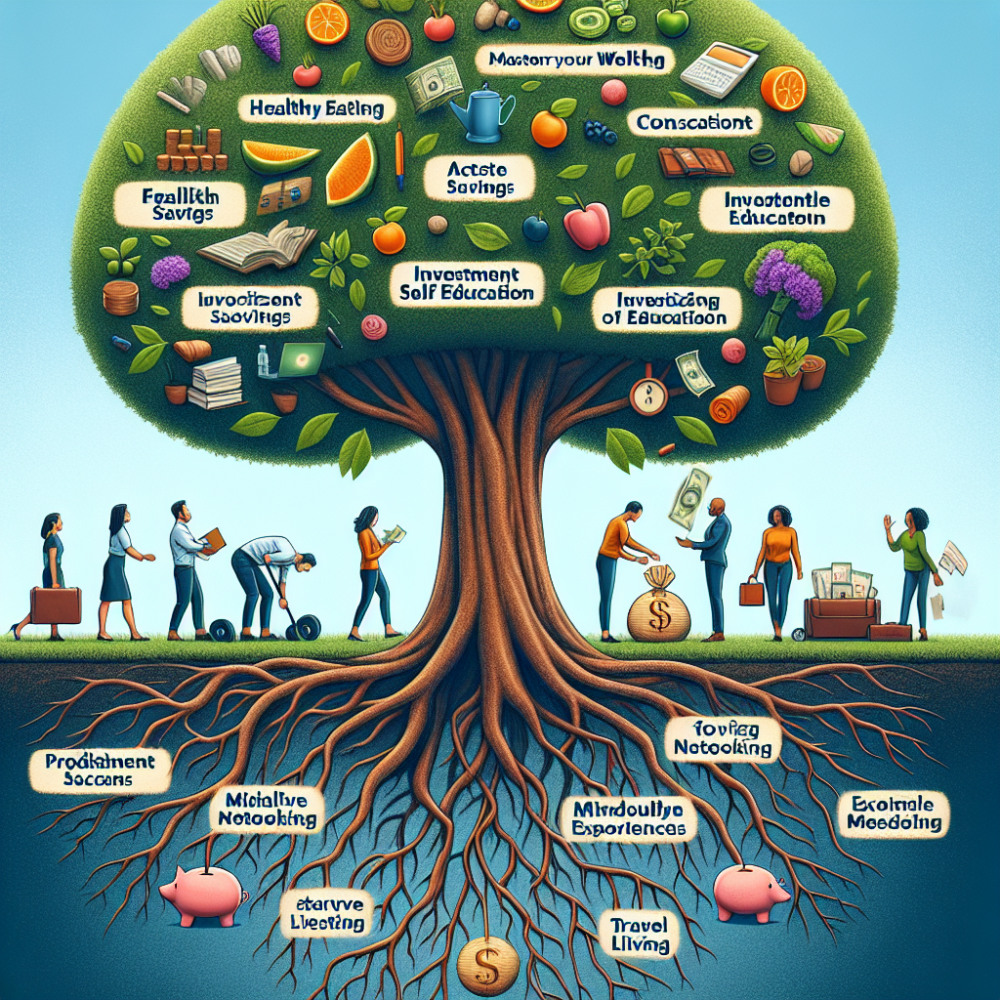

Mastering Your Wealth: 10 Lifestyle Shifts for Financial Freedom

Posted on: Monday, March 4th, 2024

Embarking on the journey towards financial independence requires more than just savvy investing or stringent savings; it's a holistic lifestyle change deeply rooted in everyday habits and mindsets. This guide provides a concise roadmap of 10 pivotal lifestyle alterations you can make to align closer with financial freedom. The focal point isn't solely on cutting expenses but on reshaping your life to value, manage, and invest money wisely. These shifts not only promise to enhance your financial health but also contribute significantly to personal growth and contentment.

1. Embrace Budgeting with Open Arms: The cornerstone of financial independence is establishing a budget that accounts for every dollar earned. This practice encourages proactive management of your finances, helping you identify areas of wasteful expenditure and reallocating resources towards savings and investments.

2. Cultivate Multiple Income Streams: Relying on a single source of income is akin to putting all your eggs in one basket. Diversifying your income through side gigs, investments, or passive income sources adds a layer of financial security and accelerates your path to independence.

3. Prioritize Debt Elimination: High-interest debt, especially from credit cards, can cripple your ability to save and invest. Adopt aggressive repayment strategies such as the snowball or avalanche methods to become debt-free faster and reduce financial stress.

4. Live Below Your Means: Adopt a minimalist lifestyle by distinguishing between needs and wants. This shift not only curtails excessive spending but also promotes a simpler, more contented way of life, enabling you to allocate more towards your financial goals.

5. Invest Wisely: Let your money work for you by investing in stocks, bonds, real estate, or mutual funds. Educating yourself on investment strategies and market performance can yield substantial long-term benefits, compounding your wealth over time.

6. Nurture Financial Literacy: Understanding the basics of personal finance, including budgeting, investing, and taxation, is fundamental. Regularly consuming financial news, books, and podcasts can empower your decision-making and foster a growth-oriented mindset.

7. Avoid Lifestyle Inflation: Resist the urge to increase your spending as your income rises. Instead, maintain a moderate lifestyle and direct any surplus earnings towards savings or investments to secure your financial future.

8. Plan for the Future: Future-proof your finances by setting up an emergency fund, contributing to retirement accounts, and considering life insurance. Preparing for unforeseen circumstances ensures stability and peace of mind.

9. Practice Mindful Consumption: Make conscious choices about your purchases, favoring quality over quantity. This approach reduces wasteful spending, environmental impact, and steers you toward more meaningful expenditures.

10. Seek Financial Advice: Consulting with a financial planner can offer tailored advice suited to your personal circumstances. Professional guidance can be invaluable in navigating complex financial decisions and planning for long-term objectives.

In conclusion, achieving financial independence isn't reserved for the few; it's accessible to anyone willing to make significant lifestyle adjustments. By integrating these strategies into your daily life, you set the foundation for lasting wealth, security, and freedom. Remember, the goal is not just to enrich your bank account, but to enrich your life in its entirety.